how to pay taxes on betterment

What Taxes Do Travel Nurses Pay. 15 2022 if you had a Betterment taxable account and.

Employer Resources For 401 K Betterment For Business

You pay yourself 60000 a year as a salary and pay the 153 self-employment tax of.

. Schools roads parks hospitals and other public works and services rely on you and your neighbors businesses organizations and estates to pay taxes that will help fund their. Credit or debit cards. If the City constructs or upgrades a sidewalk street or sewer its considered a betterment.

Any dividends earned will be taxable. Pay your taxes by debit or credit card online by phone or with a mobile device. You can pay your taxes online or by phone on the IRS own system.

Pay your taxes by debit or. This is the only one that matters for tax purposes. Uballez United States Attorney for the District of New Mexico announced that Diane Mariani of Taos New Mexico was sentenced on Oct.

These are generally taxable typically at your ordinary marginal tax rate 0-37 Federal. As with any job you will have to pay taxes on the base rate of your pay package. While you cannot deduct betterment taxes from your income when you file your federal income.

Special Property Tax A. Do you have to pay taxes on betterment. You will receive one by Feb.

So how do you pay 0 taxes when you make six figures. Repaving or replacing a sidewalk street or sewer is NOT considered a. However assuming you have a tax home you wont be.

The 1099-DIV reflects dividend payments received and capital gains distributions from stocks you own. October 21 2022 Alexander MM. 500 is in regular investment account.

A Betterment is a Financial Agreement between a homeowner and the community. Betterment does provide Form 5498 to its members as long as they have made the IRA contributions made conversions as well as rollovers in their retirement accounts on the. Read more from the IRS on Roth.

The Betterment Agreement outlines the rights and responsibilities of the community and the. Any sales where you make money will be a taxable event. Pay directly from a checking or savings account for free.

Any dividends you receive are automatically reinvested by Betterment grow tax-free and are also withdrawn tax-free. Most ETFs pay dividends which are reported on your Form 1099-DIV.

Why Betterment Has Zero Of Our Dollars Go Curry Cracker

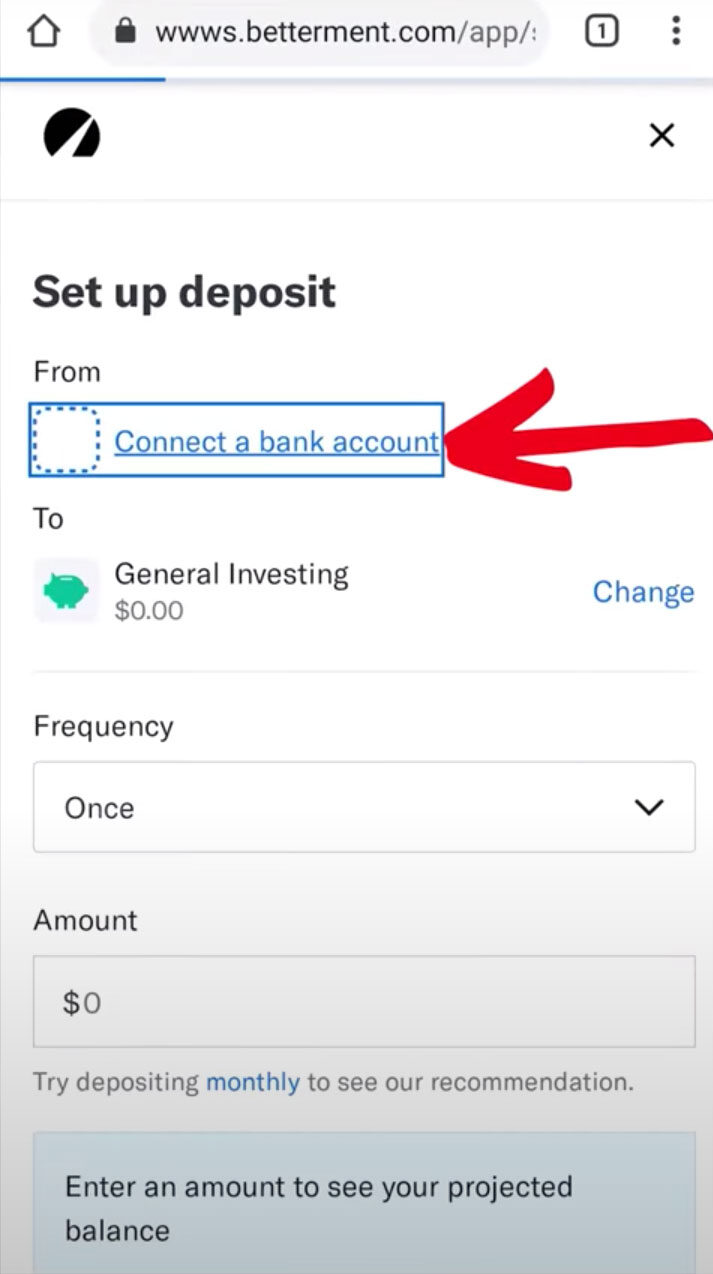

How To Open An Account With Betterment

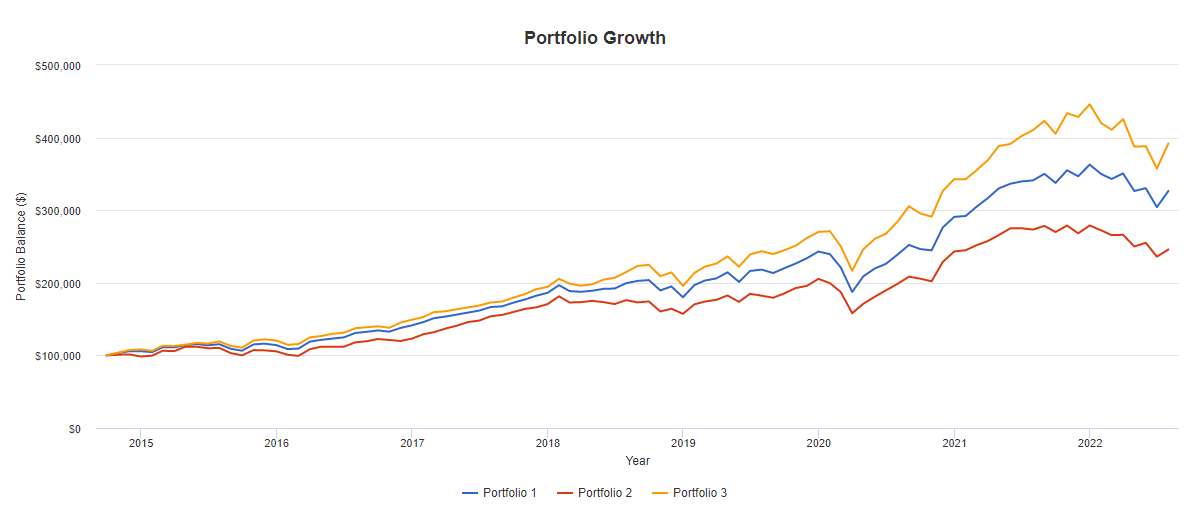

The Betterment Experiment Results Mr Money Mustache

Betterment Review How It Works Pros Cons

Betterment Investing Robo Advisor 2022 Review Should You Use It Mybanktracker

Betterment Review 2022 Pros Cons And How It Compares Nerdwallet

Betterment Review Investing Made Simple

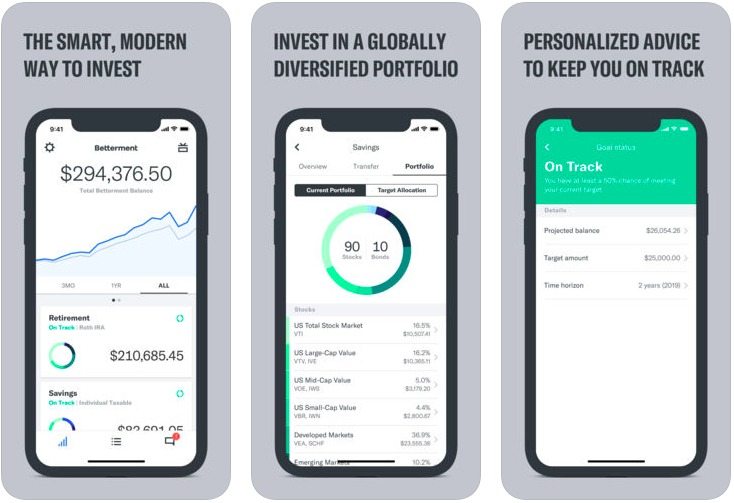

How Does Betterment Work Betterment App For Beginners Youtube

Betterment Taxes Explained 2022 How Are Investment Taxes Handled

Betterment Review How It Works Pros Cons

What Is A Betterment In Real Estate Bankrate

Betterment Review Smartasset Com

Betterment Safety Net Review A Better Place For Your Emergency Fund Millennial Money With Katie

/wealthsimple-vs-betterment-1c84228732c642fe91a5844e25b18589.jpg)

Wealthsimple Vs Betterment Which Is Best For You

Betterment Review 2022 How It Works Pros And Cons And My Honest Opinion

Betterment Review 2022 Investing Iq

Betterment Review 2022 Pros Cons And How It Compares Nerdwallet

:max_bytes(150000):strip_icc()/GraphfromDanEganBetterment-255c6f94cd1a461fa05b376d80b50c3a.png)